Fort Wright Financial Information

The City of Fort Wright Transparency Portal

In an effort to provide financial information that is more timely, clear and transparent, The City of Fort Wright is very pleased to present our Financial Transparency Portal. We have partnered with OpenGov, a leader in this space, to provide a new web-based financial transparency and analysis tool that dynamically presents the city’s revenues and expenses from historical trends to line item level details.

Through the OpenGov platform, residents, government officials and staff have around-the-clock access to easy-to-understand and easy-to-use presentation of The City of Fort Wright budget and actuals.

This is your City and your money and we encourage you to explore the portal on a regular basis. We believe that you’ll agree with us that this is a new standard of transparency and will be a powerful tool for residents and staff alike. We will continue to add new reports to the portal, so check back frequently for additional information and let us know if you have questions or reports that you think would be useful.

To be taken to the OpenGov Portal, please click the logo below.

Tax Rates

| FORT WRIGHT PROPERTY TAX RATES | 2024 Tax Rates | 2023 Tax Rates | 2022 Tax Rates | 2021 Tax Rates | 2020 Tax Rates | 2019 Tax Rates | 2018 Tax Rates |

| Real Property (per $1,000 assessed) | $2.15 | $2.48 | $2.48 | $2.65 | $2.65 | $2.79 | $2.79 |

| Tangible Property (per $1,000 assessed) | $3.85 | $4.46 | $3.80 | $4.09 | $4.09 | $4.09 | $4.09 |

| Waste Fee | $216.00 | $216.00 | $197.00 | $197.00 | $183.00 | $183.00 | $154.00 |

| Insurance Premium Tax | 8% | 8% | 8% | 8% | 8% | 8% | 8% |

| Motor Vehicle Tax | $.0200 | $0.1977 | $0.1977 | $0.1977 | $0.1977 | $0.1977 | $0.1977 |

| Payroll Tax (Occupational License Tax) | 0.99% | 0.99% | 0.99% | 0.99% | 1.15% | 1.15% | 1.15% |

Insurance Premium Tax – This tax is billed on an individual’s casualty; automobile; inland marine; and fire and allied perils insurance statements, as well as the first year of a new life insurance policy. The fee is paid to the insurance company, which in turn sends the funds to the City of Fort Wright. [FW Code of Ordinances §116, passed September 1984; amended October 1984; amended October 2012.]

All insurance companies operating in Kentucky have the option of charging a processing/transaction fee affiliated with the collection of Insurance Premium Taxes. Insurance companies are required to disclose the additional fee on the declaration page of the policy. The fee is established via KRS 91A.080(4) and 806 KAR 2:092 as follows: a reasonable collection fee may be charged and retained by the insurance company or its agent; the collection fee may not be more than fifteen (15) percent of the Local Government Premium Tax (LGPT) collected and remitted to the local government, or two (2) percent of the taxable premium, whichever is less; this fee is in addition to the LGPT payable.

Motor Vehicle Tax – Personal property taxes are collected on motor vehicles by the Kenton County Clerk as required by KRS 134.800 et seq., and then paid to the City of Fort Wright. Beginning January 1, 2024, the motor vehicle tax will be set at $0.02 per $100 of value. [FW Code of Ordinances §37.02, passed October 1994; amended october 2021; amended December 2022.]

Budget Ordinances

- 2025-2026 Budget – Ordinance 07-2025

- 2024-2025 Amendment – Ordinance 06-2025

- 2024-2025 Budget – Ordinance 06-2024

- 2023-2024 Amendment – Ordinance 05-2024

- 2023-2024 Budget – Ordinance 06-2023

- 2022-2023 Amendment – Ordinance 05-2023

- 2022-2023 Budget – Ordinance 05-2022

- 2021-2022 Amendment – Ordinance 04-2022

- 2021/2022 Budget – Ordinance 06-2021

- 2020/2021 Budget – Ordinance 03-2020

- 2020/2021 Amendment – Ordinance 05-2021

- 2019/2020 Amendment – Ordinance 02-2020

- 2019/2020 Budget – Ordinance 08-19

- 2018/2019 Budget – Ordinance 15-18

- 2017-2018 Amendment – Ordinance 01-18

- 2017/2018 Budget – Ordinance 08-17

- 2016/2017 Amendment – Ordinance 09-17

- 2016/2017 Budget – Ordinance 03-16

- 2015/2016 Amendment – Ordinance 04-16

- 2015/2016 Budget – Ordinance 08-15

- 2014/2015 Amendment – Ordinance 09-15

- 2014/2015 Budget – Ordinance 05-14

- 2013/2014 Amendment – Ordinance 04-14

- 2013-2014 Budget – Ordinance 06-13

- 2012/2013 Amendment – Ordinance 05-13

- 2012/2013 Budget – Ordinance 05-12

- 2011/2012 Amendment – Ordinance 04-12

- 2011/2012 Budget – Ordinance 03-11

- 2010/2011 Amendment – Ordinance 02-11

- 2010/2011 Budget – Ordinance 03-10

- 2009/2010 Amendment – Ordinance 02-10

- 2009/2010 Budget – Ordinance 10-09

- 2008/2009 Amendment – Ordinance 08-09

- 2008/2009 Budget – Ordinance 09-08

Fort Wright Budgets By Fund

- 2023/2024 General Fund

- 2023/2024 Fire/EMS Fund

- 2023/2024 Municipal Road Aid Fund

- 2023/2024 Parks/Recreation Fund

- 2023/2024 Capital Improvements Fund

- 2023/2024 Dixie/Kyles TIF Fund

- 2022/2023 Parks/Recreation Fund

- 2022/2023 General Fund

- 2022/2023 Dixie/Kyles TIF Fund

- 2022/2023 Fire/EMS Fund

- 2022/2023 Municipal Road Aid Fund

- 2022/2023 Capital Improvements Fund

- 2021/2022 General Fund

- 2021/2022 Parks/Recreation Fund

- 2021/2022 James A. Ramage Civil War Museum Fund

- 2021/2022 Municipal Road Aid Fund

- 2021/2022 Fire/EMS Fund

- 2021/2022 Dixie/Kyles TIF Fund

- 2021/2022 Capital Improvements Fund

- 2020/2021 General Fund

- 2020/2021 Capital Improvements Fund

- 2020/2021 Dixie/Kyles TIF Fund

- 2020/2021 Fire/EMS Fund

- 2020/2021 James A. Ramage Civil War Museum Fund

- 2020/2021 Municipal Road Aid Fund

- 2020/2021 Parks/Recreation Fund

- 2019-2020 General Fund

- 2019-2020 Capital Improvements Fund

- 2019-2020 Dixie/Kyles TIF Fund

- 2019-2020 Fire/EMS Fund

- 2019-2020 James A. Ramage Civil War Museum Fund

- 2019-2020 Municipal Road Aid Fund

- 2019-2020 Park/Recreation Fund

- 2018/2019 General Fund

- 2018/2019 Asset Forfeiture FUnd

- 2018/2019 Dixie/Kyles TIF Fund

- 2018/2019 Fire/EMS Fund

- 2018/2019 Municipal Road Aid Fund

- 2018/2019 Park/Recreation Fund

- 2017/2018 General Fund

- 2017/2018 Asset Forfeiture Fund

- 2017/2018 Dixie/Kyles TIF Fund

- 2017/2018 Fire/EMS Fund

- 2017/2018 Madison Pike TIF Fund

- 2017/2018 Municipal Road Aid Fund

- 2017/2018 Park/Recreation Fund

- 2016/2017 General Fund

- 2016/2017 Asset Forfeiture Fund

- 2016/2017 Dixie/Kyles TIF Fund

- 2016/2017 Fire/EMS Fund

- 2016/2017 Madison Pike TIF Fund

- 2016/2017 Municipal Road Aid Fund

- 2016/2017 Park/Recreation Fund

- 2015/2016 General Fund

- 2015/2016 Asset Forfeiture Fund

- 2015/2016 Fire/EMS Fund

- 2015/2016 Madison Pike TIF Fund

- 2015/2016 Municipal Road Aid Fund

- 2015/2016 Park/Recreation Fund

Other Items of Interest

- 2020 Kenton County Payroll Tax Rates

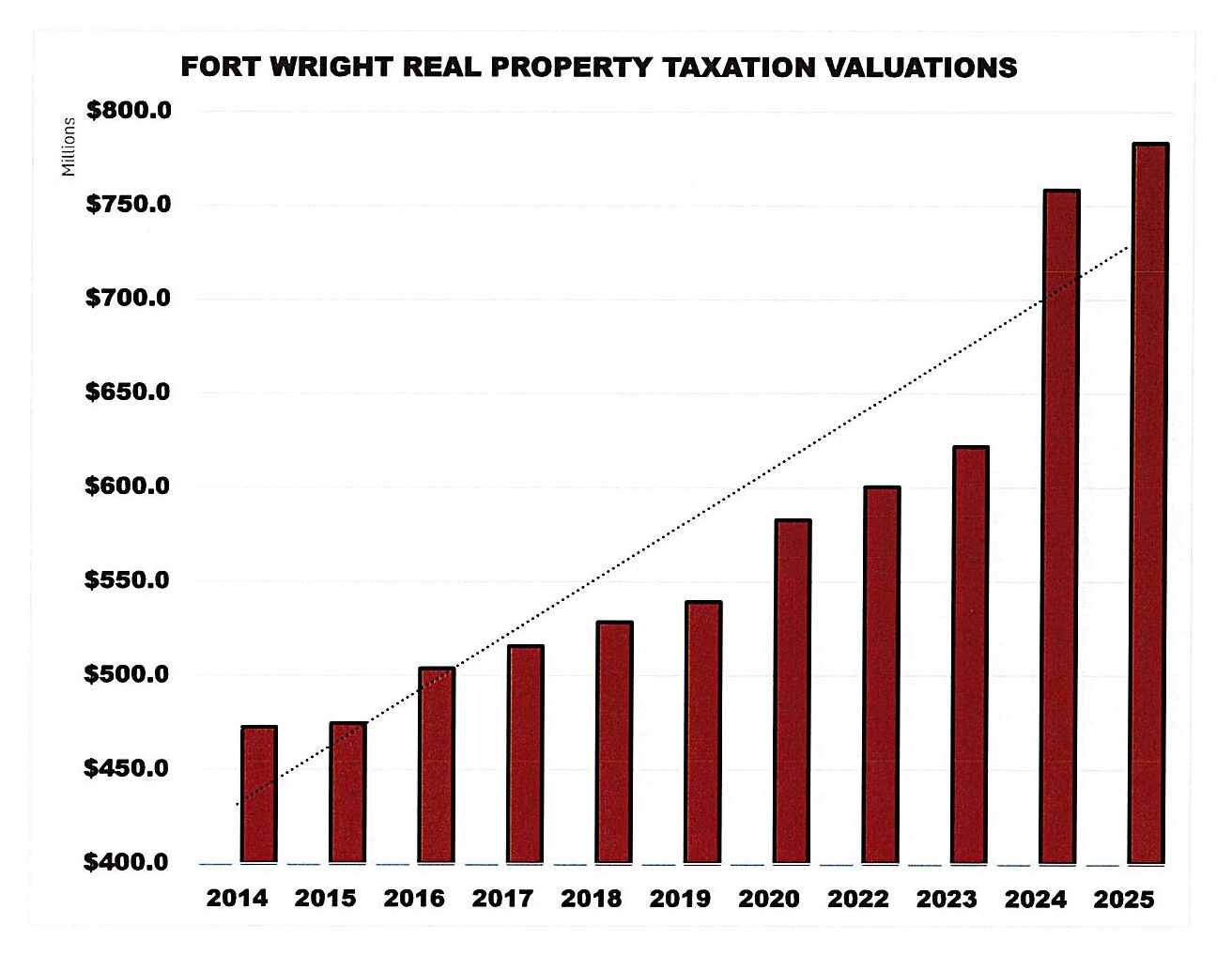

- 2020 Fort Wright Property Tax Values

- 2020 Kenton County Property Tax Rates

- Fort Wright Year Over Year Tax Rate Comparisons 2003-2020

- Fort Wright 2019 Top 10 Expenses Analysis

- Fort Wright 5-Year Summary Street Project (2019)

- 5 Year Fort Wright Property Tax Value Analysis

- Top 20 Property Tax Values in Fort Wright

- Fort Wright 2016 Capital Improvements Plan

Financial Audit 2024

The documents below provide discussion and analysis of the City of Fort Wright’s financial performance and activities during the fical year July 1, 2023, through June 30, 2024. Please click the links to view the reports.

Financial Audit 2023

The documents below provide discussion and analysis of the City of Fort Wright’s financial performance and activities during the fical year July 1, 2022, through June 30, 2023. Please click the links to view the reports.

Financial Audit 2022

The documents below provide discussion and analysis of the City of Fort Wright’s financial performance and activities during the fical year July 1, 2021, through June 30, 2022. Please click the links to view the reports.

Financial Audit 2021

The documents below provide discussion and analysis of the City of Fort Wright’s financial performance and activities during the fical year July 1, 2020, through June 30, 2021. Please click the links to view the reports.

Financial Audit 2020

The documents below provide discussion and analysis of the City of Fort Wright’s financial performance and activities during the fiscal year July 1, 2019 thorugh June 30, 2020. Please click the links to view the reports.

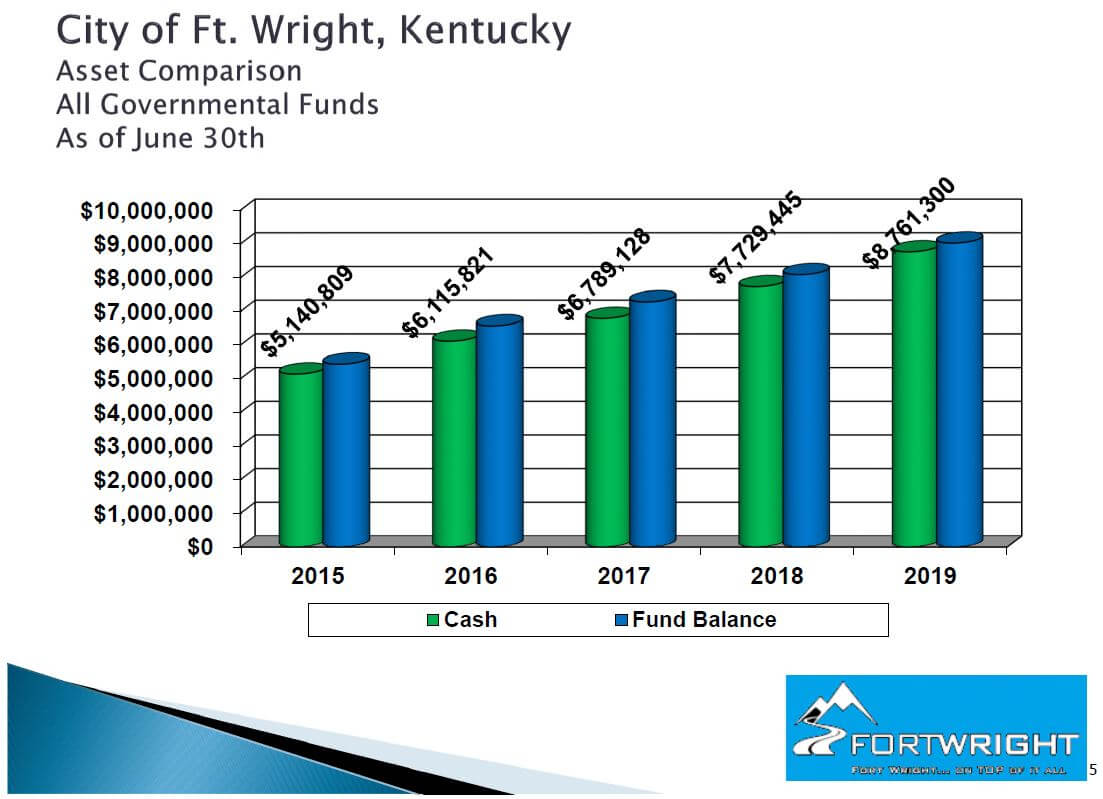

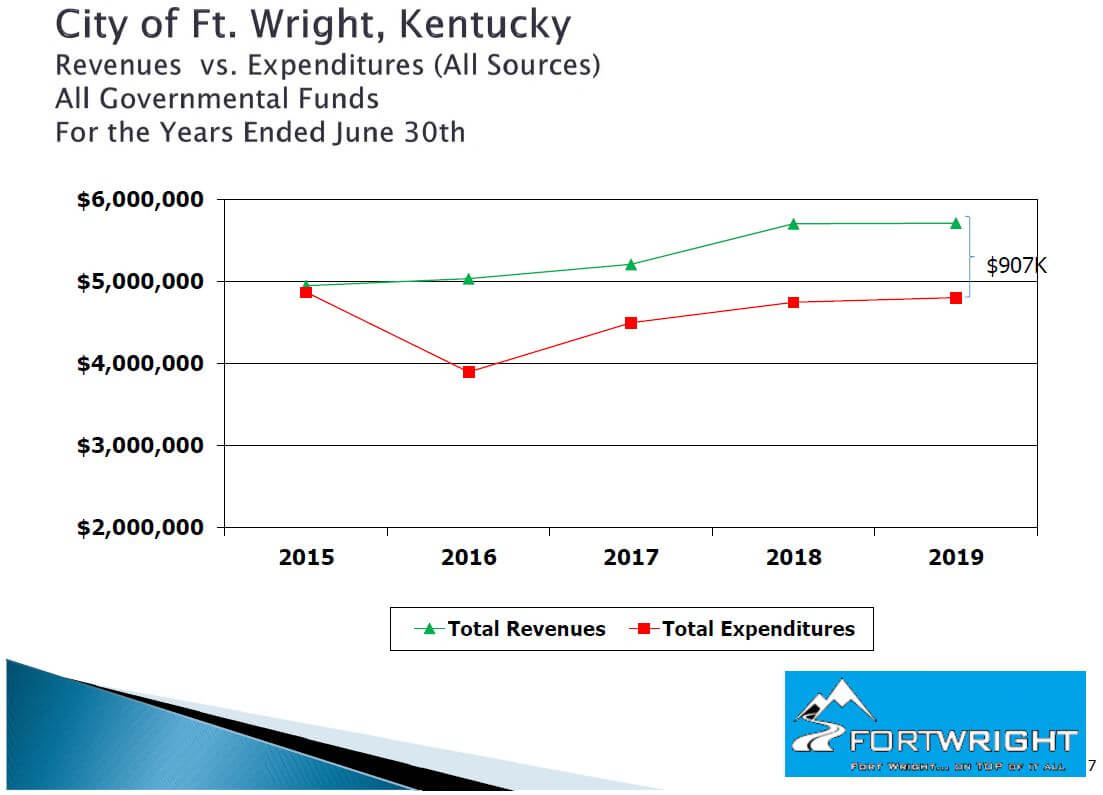

Financial Audit 2019

The documents below provide discussion and analysis of the City of Fort Wright’s financial performance and activities during the fiscal year July 1, 2018 through June 30, 2019. Please click the links to view the reports.

2019 City of Fort Wright Audited Financial Statements

City of Fort Wright Audit Presentation

City of Fort Wright Response to the Audit

Here are a few highlights from the audit:

Financial Audit 2018

The documents below provide discussion and analysis of the City of Fort Wright’s financial performance and activities during the fiscal year July 1, 2017, thorugh June 30, 2018. Please click the links to view the reports.

2018 City of Fort Wright Audited Financial Statements

City of Fort Wright Audit Presentation

City of Fort Wright Response to the Audit

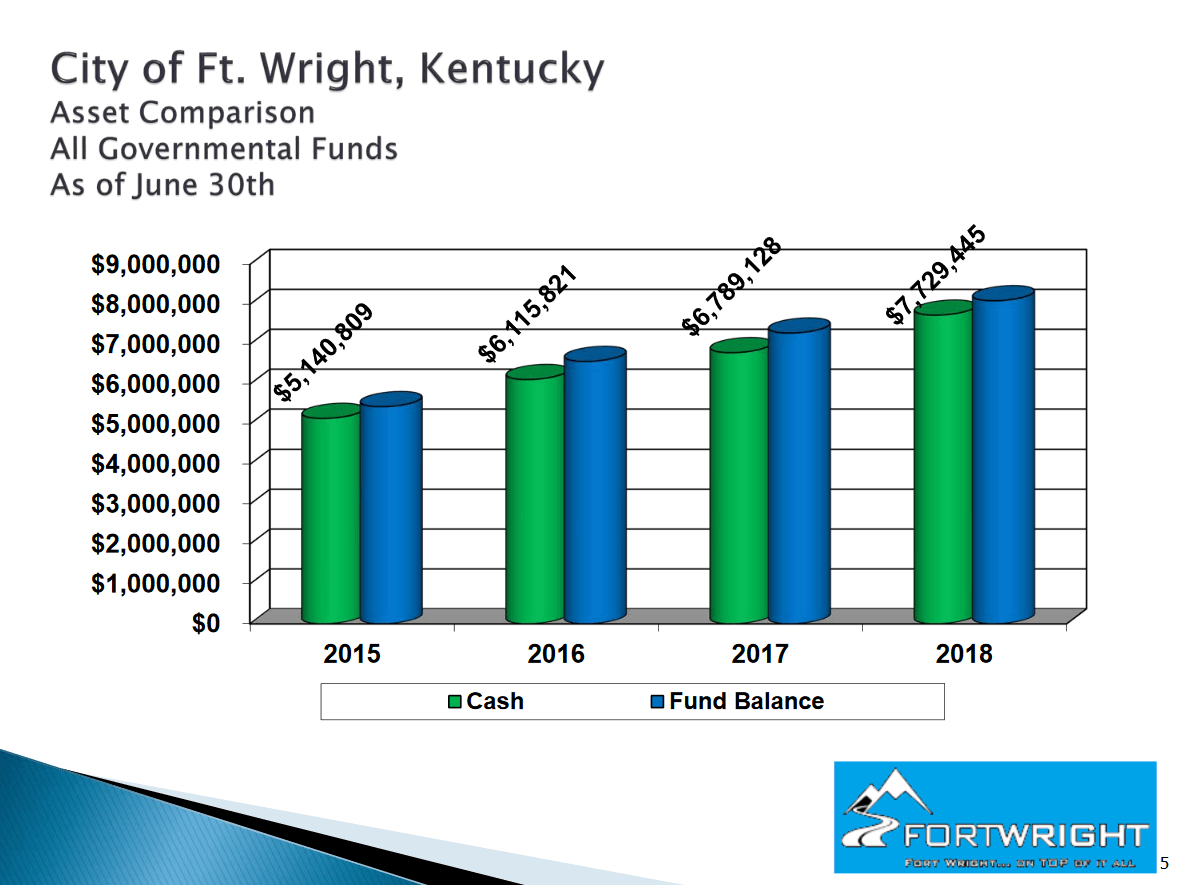

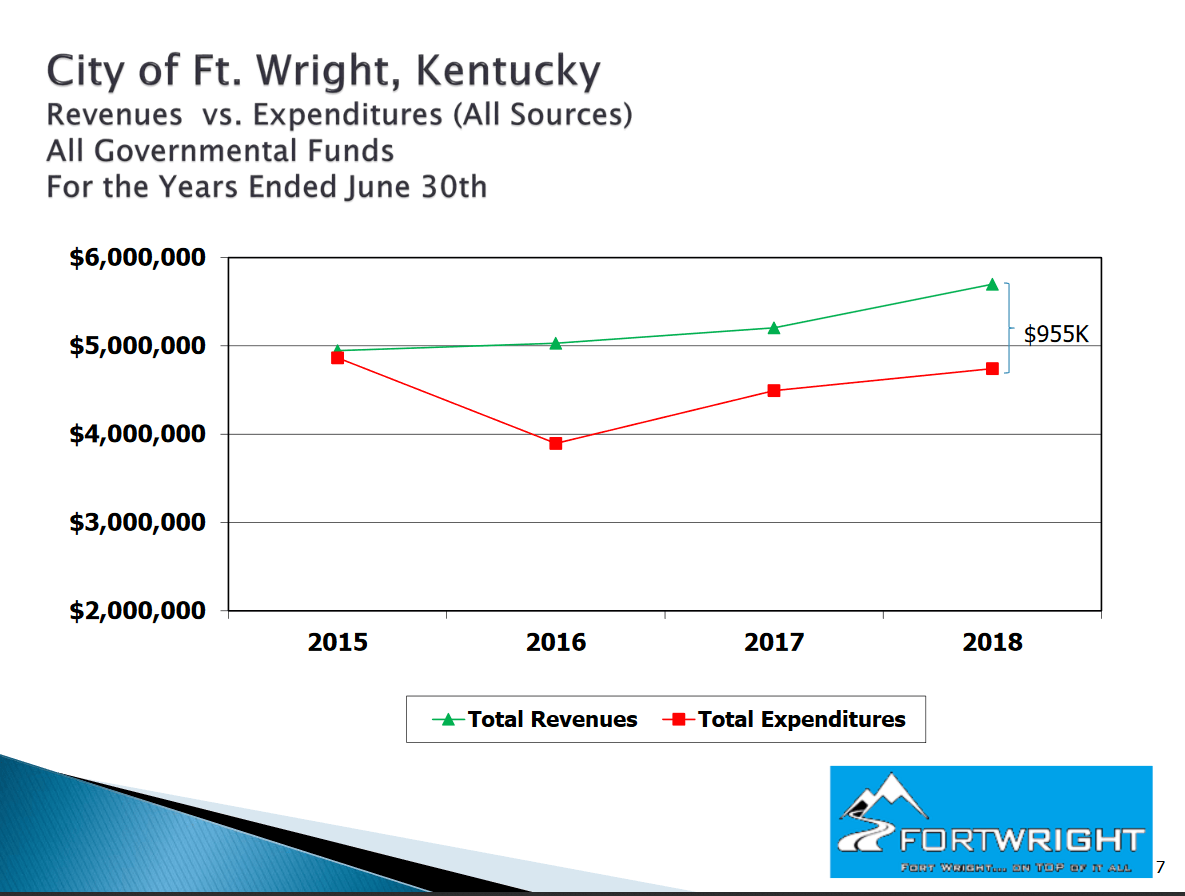

Here are a few highlights from the audit: